33+ Us mortgage how much can i borrow

As a general rule lenders want your mortgage payment to be less than 28 of your current gross income. The maximum amount you can borrow with an FHA-insured.

Feeling That Homeowner Fomo Here Are Some Tips On How To Get Started With The Home Buying Process Home Buying Process Home Buying Home Financing

Now say the mortgage rate is 4 and you want to take out a mortgage loan with a term period.

. Let your total annual housing expenses and other monthly debts be 500 and 200 respectively. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. Other loan programs are.

Find out more about the fees you may need to pay. Now you should be basing your initial calculations on 4-45 times your income. Saving a bigger deposit.

Your monthly debt obligations. How much do you have for your deposit. Its a tool to help you better understand your home financing options whether youre purchasing a new home or refinancing your current one.

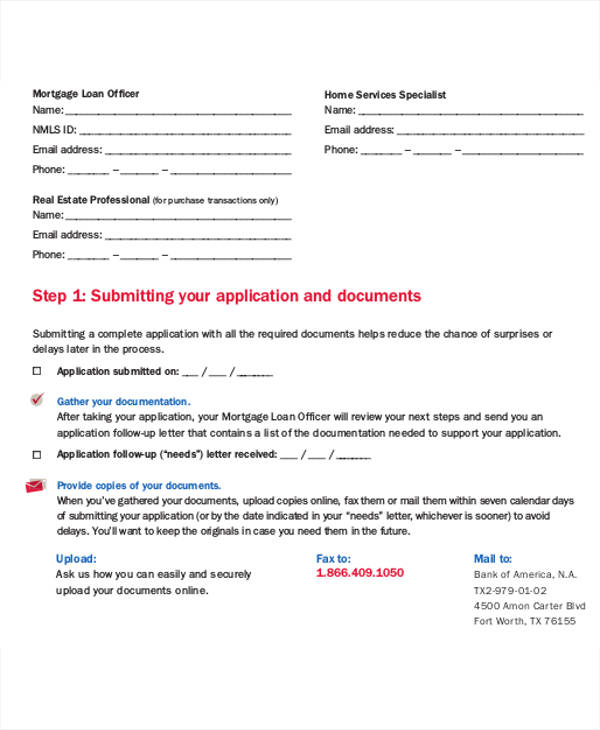

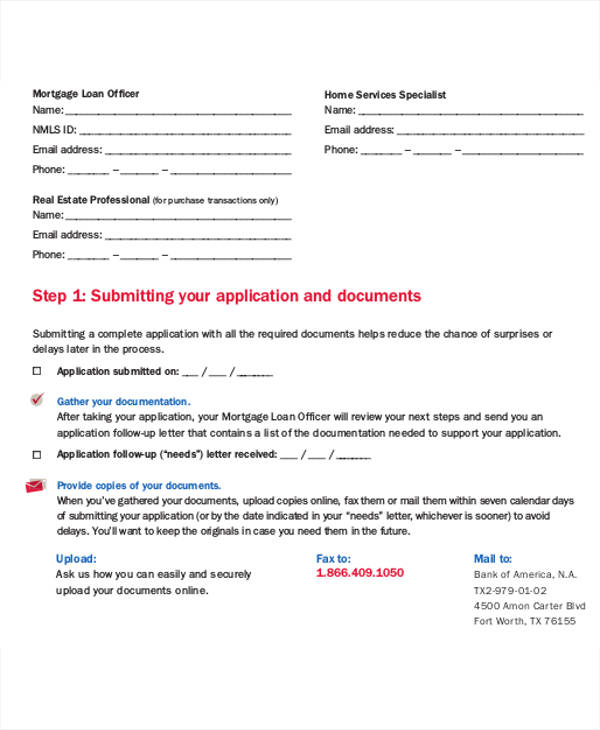

Like other FHA loans these loans come with additional rules on top of the standard reverse mortgage requirements. Across these lenders there are. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

Our clients also agree consistently rating us 5-stars for exceptional commitment. The MIP displayed are based upon FHA guidelines. For example lets say the borrowers salary is 30k.

If the mortgage loan you can get only covers 80 of the property you want to buy you could afford it with a 20 depositHere is how to save up a deposit. Serving clients for over 20 years we consider ourselves specialists in the rural home loan community. Your gross annual income.

2 x 30k salary 60000. 23 hours agoTo be able to avail this scheme the applicant needs to own the house. Please get in touch over the phone or visit us in.

For this reason our calculator uses your. A mortgage calculator will crunch the numbers for. Arizona Mortgage Banker License 0911088.

Annual homeowners insurance for your area. Figure out how much mortgage you can afford. If you earn 50000 as long as you dont have loans and credit cards that need to be accounted.

Use your salary and your partners to find out how much you could borrow. Any person who is of 60 years or more can avail the reverse mortgage scheme. Find out how much you could borrow.

Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act. Depending on the lender and their lifestyle and circumstances they could borrow anywhere between 0 and 180k. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage.

FHA requires a 35 down payment as well as an upfront and monthly mortgage insurance in many cases. Calculate how much you could borrow with our mortgage borrowing calculator. Annual real estate taxes for your area.

You could borrow up to. In case of a married. Theyll also look at your assets and.

You typically need a minimum deposit of 5 to get a mortgage.

Get Car Title Loans In Red Deer Car Title Deer Car Red Deer

30 Creative Financial Services Ad Examples For Your Inspiration Home Loans Banks Advertising Mortgage Loans

Word Of The Day Learn English Words English Words Learn Accounting

4 Steps To Help You Qualify For A Small Business Loan Loan Application Approved Loankumar Loans Loanc Business Loans Small Business Loans Personal Loans

Loan Offer Letter Template 9 Free Word Pdf Format Download Free Premium Templates

Moneylend A Search Engine For Online Business Personal Loans Personal Loans Online Business Search Engine

Our Loan Services At Nityapushta Mutual Credit Repair Services Mortgage Loans Mortgage Loan Officer

Top 5 Reasons People Take Out Personal Loans Personal Loans Unsecured Loans Person

Borrow Loan Company Responsive Wordpress Theme Loan Company The Borrowers Mortgage Payoff

Another Monday Another Mortgage Glossary Term Let Us Tell You A Little Bit About Appreciation Appreciati Home Equity Line Of Credit Mortgage Interest Rates

Bailey S Tips Come See Us At Bailey S Furniture The Home Of The No Credit Check Finance Also 6 Months Layaway As Mr Real Estate Tips Home Buying Finance

Business Loans Flat Concept Icon In 2022 Business Loans Loan Concept

How Much Can I Borrow The Key To Affordability The Borrowers Mortgage Debt Estate Tax

Avano Investments Lending Company Website Design Investing

Jumbo Reverse Mortgage Loan To Value Reverse Mortgage Info Reverse Mortgage Mortgage Loans Mortgage Info

Personal Loan Offer For Qualcomm Personal Loans Yes Bank Person

5 Signs Real Estate Agents Can Stretch The Truth Real Estate Agent Real Estate Real Estate Career